Peakoil.net

On March 5th, ASPO President Kjell Aleklett, was invited to give a lecture at University of Aberdeen in their lecture series Energy Controversies. Kjell gave a presentation called "Global Energy Resources: The Peak Oil View"

This presentation is now available in full from from University of Aberdeen.

You can find it here: http://www.abdn.ac.uk/cops/events/energycontroversies/peak-oil.php

Colin Cambell has now written newsletters for 100 months. 100 months is a long tenure. In his first letter he introduced the world to a new term, ”Peak Oil”. I first made contact with Colin by email in the autumn of 2000 when I needed a little information for a figure and I believe that it was in December of the same year that I first spoke with him by telephone. He was then writing that which would become newsletter number 1. He spoke about the idea of an organisation that would study the peak of oil production and the name ”Association for the Study of the Oil Peak” was mentioned. But the acronym ASOP did not roll off the tongue in the right way so the suggestion to swap the words around to say Peak Oil was discussed. The acronym became ASPO and the term ”Peak Oil” was coined.

Today, ”Peak Oil” is an expression that is used around the world. The Parliament of the Walloon Region of Belgium has even formed a new standing committee for Peak Oil. Around the world, presidents, national inquiries, parliamentary interrogations etc. have put Peak Oil on the agenda. I just made a search on Google using the exact term “Peak Oil” and found 2,700,000 hits.

read more

(This article is published by ASPO International, www.peakoil.net, and the article can be published as printed or on the web by making this reference. Translations to other languages are also accepted. An original Swedish version that is translated to English by Michael Lardelli can be found at Aleklett’s Energy Mix.)

Newsweek and “Cheap Oil forever”

Kjell Aleklett

President of ASPO International, Association for the Study of Peak Oil&Gas, www.peakoil.net.

Professor in Global Energy Systems, Uppsala University, Sweden, www.fysast.uu.se/ges

Newsweek’s cover declares that we shall have ”Cheap Oil Forever”.

read more

The world could run out of oil in 20 years. This grim scenario is not the prediction of environmentalists, but of Michel Mallet, the general manager of French energy giant Total's German operations. In an interview, Mallet calls for radical reduction of gas consumption and a tax on aviation fuel.

Some statements from Mr Mallet in a recent interview in Der Spiegel:

There are hardly any readily accessible oil fields anymore. The fields on the floor of the North Sea, for example, are practically empty. New reserves are only being found deep in the ocean, in remote regions like Kazakhstan or in the form of oil sands. None of this is cheap to produce.

About 87 million barrels a day are produced worldwide. In the past, it was believed that this number could be increased to 130 million. I consider that an illusion. Realistically, the capacity is less than 105 million barrels.

Read the full interview here: Der Spiegel Online

The number of exploration wells being drilled in the North Sea has collapsed by 78 per cent in the first quarter of 2009 compared with the same period last year, according to the most recent industry data from Deloitte, the accounting and consulting firm.

The worsening exploration climate could knock 10-15 years off the North Sea’s expected lifespan of 20-30 years, meaning almost half of all its infrastructure could be decommissioned within the next 11 years, UK Oil and Gas estimates.

Instead of satisfying 45 per cent of the UK’s oil and gas needs in 2020, at the current investment pace the North Sea would only be able to meet 12 per cent of its demand. Consequently, the UK and Europe will increasingly have to rely on Russia for natural gas and the Middle East for oil.

Read more: Financial Times

Russian gas monopoly Gazprom believes global demand and it own gas production will be depressed by around 10% for the next 4-5 years, its deputy chief executive said today.

"A reduction in demand of 10 percent will continue for the next 4-5 years," Valery Golubev told a conference.

Gazprom sees its position in Europe declining by 2020 as it focuses on liquefied natural gas exports and deliveries to Asia, he said in a Reuters report.

Source: Upstream Online

Japan and Venezuela today agreed a broad co-operation deal which will see them jointly develop oil and gas projects in the Latin American nation.

State-affiliate Japan Oil, Gas & Metals National Corp (Jogmec), Inpex and Mitsubishi Corporation will pursue a joint feasibility study with Venezuela on the Orinoco oil belt in the next two years, Energy Minister Rafael Ramirez said at a signing ceremony in Tokyo.

The oil belt may potentially have reserves of up to 6 billion barrels, and the ability to produce about 200,000 barrels per day, said Ramirez, who is also the head of the state oil company PDVSA.

Venezuela also agreed with four Japanese trading houses, Mitsubishi, Itochu, Mitsui & Co and Marubeni Corporation, to begin work on the development of a gas field for liquefied natural gas, Ramirez told Reuters.

Read more: Upstream Online

Platts 2nd Annual New Challenges for Crude Oil conference will address and provide the crude oil’s different market players with an outlook on the upstream, midstream and downstream sector. The recent drastic market alterations have shown the limits of a global supply driven market, especially when the understanding of the real driver mechanisms are yet to be fully mastered.

ASPO President Kjell Aleklett has been chosen as chairman for the conference. This may be seen as how ASPO and peak oil has become accepted players within the oil industry and market.

Conference agenda is available from [here].

Read more: Platts

Wall Street Journal features a recent article that looks closer on the oil situation in Russia. It concludes that oil markets may not be pricing in the extent of dwindling output in the world's biggest producer, Russia, a factor that could buoy prices later this year, traders and analysts said.

Last week, the Russian government predicted 2009 oil output of 9.68 million barrels a day, a 1.1% annual drop. But a Dow Jones Newswires survey of 12 analysts puts the decline at more than twice that rate, with the most pessimistic predicting a slump of 7%.

"We believe [Russia] will add to the growing global supply curtailment by the end of 2009, a factor which isn't fully appreciated by the market," said Oswald Clint, an analyst at Sanford C.

read more

Investment banker Matthew Simmons, author of Twilight in the Desert and a famous peak oil person, was interviewed in the business program The Agenda on channel TVO. He expressed his concerns about the oil price illusions and gave some perspectives on the pricing mechanisms and the actuall cost of oil for the consumer.

Watch the video here: Youtube

Peakoil.com

The $140/barrel price in the summer of 2008 and the $60/barrel in November of 2008 could not both be consistent with the same calculation of a scarcity rent warranted by long-term fundamentals.

What caused the high price of oil in the summer of 2008? In Understanding Crude Oil Prices (NBER Working Paper No. 14492), James Hamilton reviews a number of theories, including commodity price speculation, strong world demand, time delays or geological limitations on increasing production, OPEC monopoly pricing, and an increasingly important contribution of the "scarcity rent" associated with oil. He suggests that there is an element of truth to all of these explanations.

New solar thermal technology overcomes a major challenge facing solar power how to store the sun's heat for use at night or on a rainy day.

In the high desert of southern Spain, not far from Granada, the Mediterranean sun bounces off large arrays of precisely curved mirrors that cover an area as large as 70 soccer fields. These parabolic troughs follow the arc of the sun as it moves across the sky, concentrating the sun's rays onto pipes filled with a synthetic oil that can be heated to 750 degrees Fahrenheit. That super-heated oil is used to boil water to power steam turbines, or to pump excess heat into vats of salts, turning them a molten, lava-like consistency.

A new report charges that government subsidies for biofuels arent working and that policy makers should rethink where they spend public funds intended to reduce greenhouse gas emissions.

The report looks at subsidies aimed at nurturing Canadas biofuel industry, from money for research and development to capital investments and operating costs.

Since Caps is an investment based game it would only make sense to make peak oil applicable as an investment theory. Now Im not going to claim that Im the first on this site to base a portfolio on these issues but I do consider it an important investment area to be cognizant of. The best way of describing the opportunity of peak oil is that demand is constantly growing as emerging markets want a taste of the good life. At the same time production is falling dramatically and that represents a phenomenal spread for investors. If oil production falls 2.5% percent a year and demand rises 3% a year extrapolated over the decades that it will take the major global economies to get off of oil the spreads only get wider. This falling oil availability along with rising demand for energy is a virtual investment sweet-spot.

Many trains, equipment, facilities of largest agencies near end of useful life

WASHINGTON - More than one-third of the trains, equipment and facilities of the nations seven largest rail transit agencies are near the end of their useful life or past that point, the government said Thursday. Many have components that are defective or may be critically damaged.

NEW YORK (Reuters) - The White House has finished a review of a rule that aims to cut emissions from alternative motor fuels like ethanol, federal environmental regulators said on Thursday.

The Office of Management and Budget has completed the review of the Environmental Protection Agency's rule and "we will determine what further action to take," the EPA said in a prepared statement.

WASHINGTON (Reuters) - U.S. lawmakers on Thursday will consider legislation that would allow the federal government to override state objections to establishing corridors for new electricity transmission lines.

The draft proposal from the Senate Energy and Natural Resources committee would give states one year to provide sites for high-priority national transmission projects.

LONDON/NEW YORK (Reuters) - Oil companies are storing a record volume of oil at sea in giant tankers as world crude supply outstrips demand, and this floating oil lake is now so big that it is likely to keep a lid on prices for some time.

Shipping analysts say around 100 million barrels of crude and about 25 million barrels of refined products, such as gas oil, are held in fleets of Very Large Crude Carriers (VLCCs) in Europe, West Africa, the U.S. Gulf and off Asian ports.

DETROIT/WASHINGTON (Reuters) - Chrysler LLC filed for bankruptcy on Thursday and announced an industry-changing deal with Fiat, after being pummeled by sliding auto sales and unable to reach agreement on restructuring its debt.

Despite weeks of intense negotiations, Chrysler failed to gain full support from its lenders to avoid the first-ever bankruptcy filing by a major U.S. automaker.

The attack is the first on Ahdad for the development of which the China National Petroleum Corporation had signed a $3 billion contract with Iraq in 2008.

Peakoil.blogspot.com

Earth Day Special: Energy and Food in a World of Limited Natural Resources

Thirsty Hybrid And Electric Cars Could Triple Demands On Scarce Water Resources

The Peak Oil Crisis: Priorities

Buildings & Grounds: Food For Thought for Agriculture and the Future

'Peak oil' enters mainstream debate

The Peak Oil Crisis: Oil in the Great Recession

Natural Gas as Answer to Oil Decline Could Lead to Catastrophe, Says Leading Expert

What Next?

Take Peak Oil seriously - it'll be here much sooner than you think

Peakoilnews.info

Washington Post | Oil & Gas

Peakoildebunked.blogspot.com

EATON

Eaton is a manufacturer of hybrid drivetrains for medium and heavy-duty trucks. Just a couple of days ago, President Obama spoke at the preview of a PHEV utility truck made by Eaton, EPRI and Ford:

The plug-in hybrid truck is the first of five “boom and bucket” trucks based on a Ford F-550 chassis that will be provided by Eaton, EPRI and Ford to public and private utility fleets in the United States for use and evaluation. In addition to fuel and emissions savings while the truck is on the road, additional energy savings are available by utilizing the electric side of the system to power the ancillary systems and tools when the truck is stopped at a work site.Source

ATCO, an Alberta electric utility, is also introducing an HEV utility bucket truck Source. American Electric Power, a mid- and southern US electric utility has 4 International Durastar hybrid bucket trucks with Eaton drivetrains, and 18 more on order Source. A Michigan beer distributor recently purchased 15 medium-duty International DuraStar hybrid tractors made by Navistar with an Eaton drivetrain Source. Kraft is adopting the Durastar hybrid for transport of frozen foods Source. Honda is testing a Class 8 hybrid diesel truck made by Peterbilt (Paccar) and Eaton Source.

BALQON

The heavy-duty electric trucks being used in the Port of Los Angeles, which I described 6 months ago are now in full production. The assembly line is finished, and Balqon will first be producing 20 units for the Port of LA Source. Note that Balqon's Nautilus E30 Class 8 heavy-duty EV truck, and their Mule M-150 7-ton medium duty EV truck, are both equipped for fast-charging Source. Balqon is using AeroVironment's PosiCharge fast charge system for the Port of LA trucks Source.

SMITH ELECTRIC VEHICLES

The Smith Newton 7.5 to 14 tonne all-electric commercial truck from Smith Electric Vehicles, which has been in use in Europe for 3 years, will soon be rolled out in North America Source. Smith's UK customers include: Babcock Airports, Continental Landscapes, TK Maxx, BSkyB, DHL, TNT Express, Openreach, Sainsburys, Royal Mail, CEVA Logistics, Scottish & Southern Energy, Crown Records Management, Translinc, yoyo and Balfour Beatty Source.

MODEC

UK manufacturer Modec offers trucks in a number of styles, with a range up to 100 miles, maximum speed of 50mph, and payload of 2 tonnes. They have sold 150 vehicles since production started in 2007. Customers so far include: Tesco, UPS, FedEx, M&S, Network Rail, Speedy Hire, Stadsdeel Amsterdam Oud Zuid, CenterParcs, Hildon Water, Stadstoezicht Amsterdam, CESPA (Madrid), Deret Group (France), and UK Local Authorities (Modec vans) Source.

FORD

Ford has announced a tie-up with Smith Electric Vehicles to market a fully electric version of its Transit Connect panel van in 2010. Ford will provide the chassis, brand and marketing, and Smith will integrate the EV technology Source.

EVI

Electric Vehicles International is a new player, which apparently has a significant marketing presence in Mexico. It is now offering the customizable eviLightTruck in 3 configurations -- Class 3, Class 4 and Class 5-6 -- for the US market Source.

UPS

In May of 2008, UPS ordered 200 HEV trucks with drivetrains made by Eaton (the largest HEV order in the industry to date), and 300 CNG trucks Source. In October, they ordered 7 hydraulic hybrids, and in November, they announced an order of 12 EV trucks produced by Modec, for deployment in the UK and Germany in early 2009 Source.

UPS currently has the largest alternative fuel fleet in the parcel industry, with more than 1,500 compressed natural gas, liquefied natural gas, propane, hydrogen fuel cell, electric and hybrid electric vehicles Source.

RYDER

Ryder is offering the RydeGreen medium-duty hybrid truck based on Navistar and Eaton technology. "According to International®, the truck has the potential to provide up to 30 to 40 percent improved fuel efficiency in standard in-city pick up and delivery applications."Source

KENWORTH

In early March 2009, Kenworth (a Paccar subsidiary) received a large hybrid truck order from Coca-Cola Enterprises:

The Kirkland company, a division of Bellevue-based Paccar Inc. (NASDAQ: PCAR), said Coca-Cola Enterprises ordered 150 T370 diesel-electric tractors and 35 T370 hybrid trucks. Kenworth officials didn’t disclose the value of the order but the fuel-efficient trucks are reported to cost around $100,000 each.Another good source on this topic is the PESWiki for electric trucks. The Wiki gives an extensive list of firms, large and small, producing electric trucks.

Last year, Coca-Cola Enterprises of Atlanta (NYSE: CCE) ordered 120 hybrid delivery trucks from Kenworth. Officials at the distribution company said those hybrid trucks resulted in a 30 percent improvement in both fuel efficiency and greenhouse gas emission reductions, compared with standard delivery trucks.Source

MIT breakthrough promises lighter, fast-charging batteries

Scientists at the Massachusetts Institute of Technology (MIT) have developed a way to charge lithium ion batteries in seconds, instead of hours, that could open the door to smaller, faster-charging batteries for cell phones and other devices.The above is just one approach. A number of fast-charging technologies are already practical and being rolled out. This was also announced last week:

[...]

The breakthrough by Cedar and graduate student Byoungwoo Kang is the development of a reengineered surface material for batteries that allows lithium ions to move quickly across the surface of the battery and channels the ions into tunnels. A prototype battery built using this surface material can be charged in 20 seconds or less, compared to 6 minutes for a battery cell that does not use the material, MIT said.

The surface material is not new but is manufactured in a different way. This means batteries that use the faster-charging surface material could be on the market within two to three years, the statement said.

Nissan to trial fast charge electric car network

Pilot project in Arizona promises to charge batteries in less than 15 minutesThe Minit Charger fast-charge technology from ECOtality subsidiary eTec was developed in 1996, and 4300 stations are currently in use for fast charging forklift trucks. You can see a video of the Minit Charger in action here.

The prospect of electric cars that can be recharged within 10 to 15 minutes moved a step closer last week with the announcement of a new pilot project in Arizona.

Car giant Nissan announced that it has signed a partnership with electric vehicle charging technology firm ECOtality and Pima Association of Governments, which represents the Tucson, Arizona region, that will see the three parties work together on rolling out a charging network.

ECOtality said that it would aim to have parts of the public recharging infrastructure rolled out by 2010, in readiness for the US launch of Nissan's zero emission vehicle. Nissan added that under the agreement it would then make a supply of electric vehicles available to the regions public and private fleets.

Toshiba also has an entry in this area, the SCIB (Super Charge Ion Battery):

Toshiba gears up for fast charging battery

Toshiba is to ramp up production of a new type of Lithium Ion battery that can charge to 90 percent of its capacity in a few minutes and is highly-resistant to short circuits.Toshiba is collaborating with Schwinn on a fast-charging electric bicycle powered by the SCiB:

The Super Charge Ion Battery (SCiB) is a Lithium Ion battery based on proprietary technology developed by the company and is targeted at both industrial and electric vehicle applications and consumer laptop computer use.

Production of the battery, which has been in development for several years, has already begun for the industrial market at the relatively low volume of 150,000 cells per month.

Toshiba will increase that to several tens of millions of cells per month at a new factory it plans to build in Kashiwazaki in Niigata prefecture in north west Japan, it said last week. Construction of the factory will begin in late 2009 and production is scheduled to begin a year later, said Hiroko Mochida, a Toshiba spokeswoman.

Initial production at the factory, which represents an investment of several tens of billions of yen (several hundred million US dollars), will likely be aimed at the industrial and electric vehicle markets although the same lines will be able to make SCIBs for laptop computers, she said.

At September's Ceatec show in Japan Toshiba demonstrated a laptop running on an SCIB. The battery will keep its performance through up to 6,000 recharges -- more than ten times that of typical Lithium Ion batteries -- meaning a laptop should be able to run its lifetime on the SCiB without need to replace the battery. Due to its design it is also much less likely to catch fire or short circuit if crushed or damaged.

New Schwinn fast charging electric bicycle

In September 2008 Schwinn Bicycles announced a strategic collaboration with Toshiba Corporation that they think is going to dramatically improve the uptake of electric bicycles around the world. Schwinn presented the results of this collaboration at the recent Interbike International Bicycle Expo in the form of the Tailwind.Here's a fast charging battery technology for buses:

The Tailwind incorporates Toshiba’s new Super Charge ion Battery (SCiB) technology. The SCiB technology will enable Tailwind owners to recharge their battery in 30 minutes through a standard electrical outlet or as little as five to seven minutes through a commercial charger. By comparison, it takes four hours or longer to fully recharge the battery of most other electric bicycles.

Proterra claims electric vehicle batteries can recharge in 10 minutes

Battery recharging times remain a major obstacle for electric vehicles. But perhaps not for long. Proterra claims that its new all-electric buses can recharge in as little as ten minutes.More info on Proterra here.

Last week the company demonstrated one of its buses in San Jose (see the video below). Seattle and San Francisco are also considering buying the Proterra's buses.

Last week, it was also announced that the Tesla will have 440V fast-charge capability, similar to the Minit Charger specs. Apparently Nissan's upcoming TBD all-electric car will also have the ability to fast charge in 26 minutes.

It would seem that fast charging technology is already here.

Best Buy is getting into motorcycles – think Geek Squad in mechanics' coveralls.Here's the photo and the specs:

The consumer electronics store chain is going to start selling the Enertia electric motorcycle made by Ashland, Ore.-based startup Brammo at five of its West Coast stores in May, CEO Craig Bramscher said Friday.

In time, Bramscher envisions the $12,000 Enertia, as well as Brammo's upcoming lighter-duty and heavier two-seater models, being sold across Best Buy's chain of 1,200 U.S. stores, as well as some of its 1,500 or so stores in Europe and its 270 stores in China.Source

Top speed: 50+ mph

Recharge time: ~3 hrs

Range: 35-45 miles

MPG equivalent: 276

Price: US$ 12000

This one's a little pricey, but even today it has dozens of hungry competitors, many at much lower prices. It makes you wonder: are conventional car manufacturers and dealers yesterday's news? Why wouldn't electric manufacturers and retailers muscle in on scooters and other LEVs (Light EVs)? After all, they're just another electrical appliance. Just as we can expect electric companies to behave more like (or be taken over by) oil companies in the coming post-oil EV era, perhaps we should expect existing electronics/electric firms to play an increasing role in vehicle manufacturing and retailing. It's like I said a while back: electric scooters are going to be the next ipod. We'll be stamping them out by the millions, in 8 trendy colors.

Which means that Ken Deffeyes has crapped out once again, adding yet another flub to his long and sorry list of blown predictions. I've gone into depth about this before, but here's the recap. When we last left him, Ken had erroneously predicted peak oil for:

2000

2003

2004-2008

2004

Nov. 24 2005

Dec. 16 2005

Nov. 2005-April 2006

In early 2007, Deffeyes waffled once again -- this time backwards, to May 2005.

The US Energy Information Agency publishes monthly estimates of world oil production at www.eia.doe.gov/ipm/t11d.xls. (Microsoft Office Excel Workbook) Of course, we hope that their estimates are not politically biased. Their current posting shows May 2005 as the month of greatest world oil production. Earlier, I estimated that the peak would be in December, 2005, but May will do. I'll take it. I'll take it.SourceAs you would expect, this latest adjustment also turned out wrong. According to the very spreadsheet Ken references, the May 2005 level 74.241kbd was surpassed in July 2008, reaching 74.831kbd. Naturally, he had nothing to say about this on his website. For him, making predictions is like a bear shitting in the woods. Just kick some dirt over the last one when it starts reeking, and grunt out the next one.

Of course, there's always the old standby: "We'll see who gets the last laugh, JD. Someday Ken's going to be right." Actually, I would dispute that. My current conjecture is that oil will never peak as long as Ken Deffeyes is making predictions. That's how truly rank his predictions are. But whenever Ken finally shuts up and oil actually peaks, it's not going to be Ken who is proven right. We're all going to be proven right. Me, Mike Lynch, Daniel Yergin, CERA... literally everyone (aside from the mentally retarded) concedes that oil will peak. So on that glorious day when we're all proven right, I say we all go out for a rousing mutual backslap and group hug!

More broadly, we should note that Ken, like many peak oilers, has been trying to stack the deck by restricting his prediction to conventional crude. The reality is that Ken's "peak" is being swamped by flows of unconventional liquids such as tar sands and (most importantly) NGL, as you can see in the IEA figures for total liquids:

A while back, Ken liked to talk about the "Cornucopian Cemetery", where cornucopians go when they admit that oil has already peaked. We have a similar feature here at Peak Oil Debunked. I call it the Peak Oil Prophet's cemetery. It's where you go after your 9th incompetent prediction of the peak oil date craps out.

A while back, Ken liked to talk about the "Cornucopian Cemetery", where cornucopians go when they admit that oil has already peaked. We have a similar feature here at Peak Oil Debunked. I call it the Peak Oil Prophet's cemetery. It's where you go after your 9th incompetent prediction of the peak oil date craps out.Hey Ken. Your ride is here.

by JD

by JD

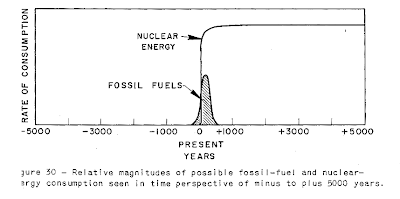

(Image from M. King Hubbert's 1956 paper "Nuclear Energy and the Fossil Fuels")

(Image from M. King Hubbert's 1956 paper "Nuclear Energy and the Fossil Fuels")Kentucky House panel approves nuclear bill

The Tourism Development and Energy Committee of the Kentucky House has approved a bill that could lead to the lifting of a 25-year-old moratorium on the construction of nuclear power plants within the US state.Georgia lawmakers OK early recovery of nuclear costs

The Georgia House voted Thursday to let Georgia Power Co. begin charging customers for a planned nuclear power plant five years before it is due to go into service.Iran tests first nuclear power plant in Bushehr

The bill, which passed 107-66, already has cleared the Senate and now heads to Gov. Sonny Perdue for his signature.

It would allow the utility to recover $2 billion in financing costs for the $14.4 billion expansion of Plant Vogtle near Augusta. Georgia Power plans to charge ratepayers $1.30 per month for the plant in 2011, when construction is due to begin.

The charge would continue to increase by that amount each year until 2016, when the first of two new nuclear reactors is scheduled to begin operating.

Iran began testing out its first nuclear power plant on Wednesday in the southern port of Bushehr, the New York Times reports.Most Asean members want nuclear power

Iranian officials say that fuel rods made of lead were used in place of nuclear fuel in order to test the 1,000 megawatt, Russian-built nuclear plant, according to the ISNA student news agency.

Deputy head of Iran’s Nuclear Energy Organization Mohammad Saeedi told reporters that the fuel rods contained lead instead of the usual uranium.

Meanwhile, Sergei V. Kiriyenko, the head of the Russian nuclear agency which helped built the power plant, said that the plant was “nearing its final stages before launching,” during his visit to Iran and that the construction was finished.

Russia supplied Iran with the nuclear fuel to build the plant under arrangements of the International Atomic Energy Agency (IAEA), which is the same UN agency that monitored the nuclear plants in North Korea’s Yongbyong.

According to an IAEA report released last week, Iran is planning on loading fuel during the second quarter of 2009.

Most of the members of the Association of Southeast Asian Nations are amenable to tapping nuclear power to promote alternative sources of energy, an official said yesterday.After a 20-year ban, France helps Italy embrace nuclear energy

They expressed support for the idea even as they prepared to sign an agreement today that will allow governments to sell their oil to neighbors at “friendship” prices.

“Nuclear energy is being seriously looked at, but we are still very much at the preliminary discussion stage, at the technical working group level,” Asean Deputy Secretary General Pushpanathan Sundram said in an interview during the Asean Business and Investment Summit.

“There are some that are opposed to it, while others are pushing for it,” he said.

Those in favor of creating or reactivating nuclear plants are Thailand, the Philippines, Vietnam, Laos, Malaysia, Myanmar and Indonesia.

Twenty years after banning new nuclear plants, Italy is turning to France to restore its nuclear program.Workforce education for a nuclear energy revival

On Tuesday, Italy’s Prime Minister Silvio Berlusconi signed a cooperation deal with President Nicolas Sarkozy for the construction of four power plants in Italy.

Italy shut down its four nuclear plants following a 1987 national referendum that rode a wave of fear and outrage over Russia’s Chernobyl reactor meltdown. Now it is joining a growing number of European countries – including Germany, Slovakia, and Bulgaria – that are returning to nuclear energy due to concerns both about carbon emissions and about the reliability of energy supplies from Russia.

A rapidly growing demand for more electricity – from cleaner energy sources – has nuclear power poised for a revival in the United States.Wisconsin regulator says nuclear should be an option

The Nuclear Regulatory Commission (NRC) expects companies in the energy industry to apply in the next two years for construction and operation licenses for more than 30 nuclear power plants.

To respond to the demand for more expertise in the field, the Ira A. Fulton School of Engineering at Arizona State University is launching a graduate-level program in nuclear power generation.

Wisconsin Public Service Commission Chairman Eric Callisto told attendees at an energy conference Monday that he believes legislators will end the state's ban on new nuclear power plants. But Tia Nelson, co-chairwoman of the Governor's Global Warming Task Force, called nuclear energy a "distraction" from efforts toward conservation and energy efficiency.Oklahoma nuclear power bill advances in committee

Oklahoma lawmakers signaled their interest to go nuclear, approving legislation that would streamline the state's regulatory process and provide new incentives to build a nuclear power plant.Toshiba wins US nuclear plant projects

Japan's Toshiba Corp. said Wednesday it had won a contract to build two nuclear plants in the United States that are scheduled to start generating power in 2016.Two new nuclear power stations planned for Cumbrian coast

It is the first such contract a Japanese company has won overseas, covering the projects entirely from engineering and procurement to construction of the nuclear plants, the company said.

Under the contract, Toshiba America Nuclear Energy Corp., a US-based Toshiba subsidiary, will build two Advanced Boiling Water Reactor (ABWR) nuclear power plants in Texas.

The plants, the first ABWRs to be constructed in the United States, will have an output of approximately 1,400 megawatts each, the company said.

Two new nuclear power stations could be built on farmland in west Cumbria, as well as those already predicted for the Sellafield site.W.Va. lawmakers propose nuclear power ban repeal

A German energy firm has revealed plans to build reactors on coastal sites near Egremont and Millom. These are separate to plans for reactor development on land around Sellafield.

Some West Virginia lawmakers hope to add nuclear power to the state's energy portfolio.Algeria to erect nuclear Power plant

A bipartisan group of senators has introduced legislation to repeal a partial 1996 ban on the building of nuclear power plants.

"A ban is inconsistent with West Virginia's claim that it is an energy state," said Sen. Brooks McCabe, the bill's lead sponsor.

The Algerian government has announced its plans to erect the first ever nuclear power plant by 2020, Energy and Mining Minister Chakib Khelil has said.Jordan, Russia sign nuclear deal

Minister Khelil said Algeria will also build new plants every five year after the erection of the fisrst station.

The Minister said Algeria has already signed civil nuclear agreements with Argentina, France, China and the United States. “Algeria presently has two experimental nuclear plants in Draria, in the suburbs of Algiers and another one in Ain Oussera, near Djelfa about 300 kms from capital Algiers,” he said, stating that further negotiations were underway with Russia and South Africa.

Russia, which is helping Iran build its first nuclear plant, inked a preliminary cooperation deal with Jordan on Thursday to pave the way for producing nuclear power in the energy-poor kingdom.Yucca Mountain is Dead! Long Live Fast Breeders?!

Under the agreement, Russia will help Jordan, which imports around 95 percent of its energy needs, build power and desalination plants as well as research centres, Jordan Atomic Energy Commission head Khaled Tukan said.

"A final agreement will be signed in Moscow by the end March," Tukan told state news agency Petra after signing the deal with Nikolai Spassky, deputy director of the Russian Federal Agency for Nuclear Energy.

The Obama administration's new budget essentially kills the Yucca mountain radioactive waste repository project. The original goal was to build a facility in which to safely store high level radioactive wastes from America's 104 nuclear power reactors. Anti-nuke environmentalist ideologues have long opposed the Yucca mountain facility. Their goal is make nuclear power impractical by blocking the waste disposal stream. But perhaps they've outfoxed themselves. nukepowerNow Even “Greens” Are Turning To Nuclear Power

The new budget promises that the Obama administration will “devise a new strategy toward nuclear waste disposal.” Well, there is already a strategy that will work, using fast breeder reactors to burn up waste and simultaneously produce more reactor fuel.

Nuclear power has new converts, according to top UK environmentalists, as they made public their belief that this energy source is still required.India Targets 6,000-MW of Nuclear Power in 2009

Many have long opposed nuclear power because of the risk of weapons proliferation, as well as the difficulty of waste disposal.

In spite of worries about nuclear power, global warming is seen as a more serious hazard.

Nuclear is seen as an improvement over new coal-fired power plants.

Britain will have a key energy gap over the coming years.

Coal burning power stations and ageing nuclear power facilities will shutdown and the government is obliged to reduce carbon emissions by 80 per cent, not later than 2050.

Therefore, many environmentalists are converting back to nuclear power.

In a momentous piece for the Independent newspaper, a member of the Green Party, a past head of Greenpeace, and Lord Smith, Chairman of the Environment Agency and a prominent columnist, made known their coversion to supporting nuclear energy.

The agreements with AREVA and TVEL come at a time when three reactors in the country are set to commence production. Units 5 and 6 at the Rajasthan Atomic Power Plant (2 X 220 MW), Unit 4 at the Kaiga Power Plant in Karnataka (220-MW) and one unit at the Koodankulam Power Plant in Tamil Nadu (1,000-MW) will go live this year. The steady supply of fuel is expected to boost atomic power production from the existing 17 facilities to about 6,000-MW by the end of 2009, with the reactors expected to operate at about 90 percent of their combined installed capacities.German State Calls for Extension of Nuclear Power

NPCIL is also embarking on a joint venture with NTPC Limited (New Delhi) to establish new nuclear plants in India based on indigenous "fast breeder reactor" technology. Five other reactors with a production potential of 2,660-MW are already under construction. The Atomic Energy Commission recently said that India would have 20,000-MW of nuclear power by 2020.

Germany’s largest producer of wind- powered electricity, the northern state of Schleswig-Holstein, should extend the use of its three nuclear power plants, a government minister said.Tender for Armenian nuclear power station

A mix of energy, including nuclear power, is the most sensible way to guarantee energy security and cut carbon-dioxide emissions, said state economy minister Werner Marnette, a member of Chancellor Angela Merkel’s ruling Christian Democratic Party.

The minister’s comments renew the debate over atomic energy ahead of German federal elections later this year and follow Sweden’s Feb. 5 decision to scrap a ban on new atomic plants.

“It’s essential that we allow our three nuclear plants to keep running or we won’t have enough energy,” Marnette said today in an interview in Husum. “Of course, we have to work on the security issues as well as the problem of waste.”

The Armenian Government has announced a tender for holding a competition which will identify which company should undertake the construction of a new nuclear power station in the country. In 38 days the tender commission will announce the winner of this tender, who will then hold the competition and thereby identify the most appropriate power station constructor.China may help Vietnam build N-reactor

A Chinese firm has started talks to help Vietnam in building its first nuclear power project to reduce electrical shortages in the country.Manitoba town pushes for nuclear reactor

China Guangdong Nuclear Power Group (CGNPG), one of the two main nuclear power plant operators in the country, announced Monday it was in talks with Vietnam to help the country construct its first nuclear power plant.

According to a report on the website of the Shenzhen-based company, Vietnam plans to build two 1,000-mW reactors in Ninh Thuan Province on the lower central coast.

Vietnam plans to build nuclear power projects with a total capacity of 4,000 mW by 2021, a CGNPG executive who declined to be named said.

The town of Pinawa, Man., may be in line for a nuclear renaissance.Third reactor at North Anna nuclear power plant debated

The town of 1,500, 110 miles northeast of Winnipeg, is in discussions with Atomic Energy of Canada Ltd., to possibly build a nuclear power plant on the site of AECL's Whiteshell Laboratories.

Dale Coffin, a spokesman for AECL, said it's very much in the early discussion stage but said the idea of putting up a nuclear power plant in Pinawa is a good one.

``From our point of view, Pinawa is already a licensed site, there are already experienced people working there, abundant water near by and it's close to the United States and transmission lines,'' said Coffin. ``There are some very positive features there already.''

About 100 people turned out last night to argue for and against plans to build a third nuclear reactor at Louisa County's North Anna Power Station.Sweden lifts ban on nuclear power

The U.S. Nuclear Regulatory Commission is evaluating the potential environmental impact of a third reactor at the nuclear power plant near Mineral. The agency used last night's meeting to gather public comments.

Nuclear power received a significant boost today when the Swedish government announced plans to overturn a near 30-year ban on atomic plants as part of a new drive to increase energy security and combat global warming.Kuwait eyes nuclear power with French help - paper

Ministers said they would present a bill on 17 March which would allow the construction of nuclear reactors on existing sites and introduce a new carbon tax as part of a programme to cut carbon emissions by 40% on 1990 levels by 2020.

Kuwait is considering developing nuclear power with the help of a French firm to meet demand for electricity and water desalination, the country's ruler said in remarks published on Wednesday.

"A French firm is studying the issue," daily al-Watan quoted Emir Sheikh Sabah al-Ahmad al-Sabah as saying, adding that the oil-rich Gulf Arab state would only put nuclear power to civilian use and according to international laws.

Nuclear power would "save a lot of wasted fuel in electricity and water desalination plants", he said, giving no further details. The emir did not specifically refer to any French firm in his published remarks.

It reminds me of an inconsistency I often noticed when oil prices were skyrocketing. Many doomers were simultaneously claiming that: a) the economy was dying, and b) oil prices would continue to go through the roof. Something had to give, and as we all now know, that turned out to be claim b).

Now we've got the same contradiction all over again. Naturally the doomers are jazzed that the credit crisis is sending the economy into a death spiral, but at the same time they keep talking about oil prices soaring "when the economy comes back". It doesn't add up. If the financial crisis is a death spiral, the economy isn't going to come back for a long time. I keep wondering, are they just in denial, hoping for their oil portfolios to come back?

Consider the Asian Financial Crisis of 1997. That was peanuts compared to what we've got happening now, and it knocked the price of oil down to $10 a barrel -- equivalent to only $13 a barrel in 2009 dollars. It would seem that oil has a lot more room on the downside.

The Wall Street Journal Blog is starting to wonder:

With already tottering demand getting even weaker, oil bulls are having second thoughts. Barclays Bank, which for months has warned oil prices will rebound because of supply shortages, slashed its 2009 forecast for Brent crude to $61 from $70.Another skeptic says the unthinkable in Your Oil Stocks Aren't Coming Back:

Remember when Intel (INTC), Microsoft (MSFT), Dell (DELL), Lucent (ALU), Yahoo (YHOO) and Cisco (CSCO) ruled the markets? There was an era, roughly 1997 to 2000 when those stocks actually mattered. They were important companies doing big things in terms of providing the technology needed for the next century’s communications and internet build-out. And then, they just didn’t matter anymore. Once the dot com bubble burst, every bounce or rally in these names was basically a selling opportunity…for 8 years and counting! See the above chart for a notion of how frustrating it must have been to stay positive on NASDAQ tech names.Traders talking about "dumb money" in the oil markets:

It took a long time for people to get it through their heads that these stocks had seen the best valuations and prices that they would ever see. Investors couldn’t imagine a world where these stocks would no longer be important, but with each passing quarter and year, these NASDAQ Generals diminished in stature and market cap.

I believe that this story is repeating itself in the oil patch. Market participants seem to be in a state of disbelief that Chesapeake (CHK), Transocean (RIG), National Oilwell Varco (NOV) and ConocoPhillips (COP) aren't important anymore. These stocks may have have seen the best levels they will ever see, at least for a long time.

Flynn expects oil prices to eventually drop well below $30 a barrel in coming months as manufacturers cut operations and millions of laid off workers stop commuting to work.More in the same vein from Rigzone (hat tip to OilFinder):

"We're getting ready for a tailspin, but you just don't know what's going to happen," Flynn said. If it weren't for the new federal stimulus package and promises of further OPEC production cuts, "we'd probably already be there."

Trading on the Nymex has been erratic because of a influx of "dumb money" entering the market, analyst Stephen Schork said. Amateur investors are flocking to energy funds that have bet crude prices will eventually spike again.

"They're looking at the fact that crude went to $150 a barrel a year ago, and its in the 30s today," Schork said. "They think it's going back up."

Oil Cos' Bet on Swift Price Rebound Has Its Risks

Major oil companies are trying not to repeat the mistakes of the last price slump in the late 1990s, when cutting back on investment left them ill-prepared to meet growing demand in later years. This time they promise to maintain investment through the current price dip, but the risk is growing that a prolonged slump could stymie their plans.

If the years ahead follow the pattern of the last major recession in the early the 1980s, where global oil demand shrank during the downturn and remained well below production capacity for years, even as the recovery accelerated, prices may stay low for much longer than current expectations. Steady as she goes may be their mantra for 2009, but oil chiefs may be on course for some tough choices in 2010.

[...]

We are barely six months past the last peak in the oil price, but OPEC already has 8 million barrels a day of spare oil production capacity after big output cuts, said the group's Secretary General Abdullah Al-Badri. The group is very concerned about the impact the economic downturn will have on the medium- and long-term oil demand, he said.

OPEC's spare capacity looks likely to grow. Thanks to investment in the boom years, the world's productive capacity should grow faster between 2009 and 2012 than it did from 2003 to 2008, said a report from U.S.-based consultancy Cambridge Energy Research Associates.

Companies May Face Massive Cash Outflows

If companies do not reduce their upstream investment at all during the current economic downturn, CERA said spare capacity could reach 10 million barrels a day by 2013. "This would be an unprecedented margin and would tend to undermine the oil price," the consultancy said.

The main difference is that the pessimists focus obsessively on the supply side. They are committed to the idea of societal breakdown or collapse, so they constantly fret about supply, like Dave Cohen:

Here's the main point: Can anyone, anywhere, point to a large new secure supply of crude coming online anywhere in the next few (5) years that solves the supply and demand equation in that time frame and beyond? I think not.When the IEA draws some crazy curve which says world demand is going to be 121mbd in 2030, pessimists like Dave really take it to heart. They genuinely think that the world is going to need that much oil. That is why they are pessimistic. The world will need 121mbd, but it's unlikely that amount will be forthcoming, so the system is going to breakdown.

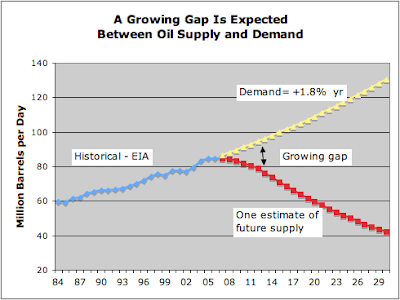

That's the doomer view in a nutshell, and it's nicely captured in a recent graph from the Oil Drum, which Gail Tverberg uses to terrorize the wide-eyed newbies in her presentations on peak oil:

Note that Gail and her fellow pessimists are very careful to never question the unexamined doomer assumption, i.e. to ask: "Is all that oil really necessary?"

I, on the other hand, am an optimist. I believe that most oil is wasted and conservation is actually quite easy. I don't believe we need most of the oil we are using today, so the failure to meet the 121mbd target is not really a big deal. Like I wrote back to Dave:

The error in your ways is that you are thinking only in terms of supply side solutions. You think that the failure to meet demand is a terrible problem. It's not. Most oil demand is for frivolous, wasteful uses (like single person commuting in the U.S.) It's a form of addiction, and demand destruction isn't a bad thing, it's "healing" or "getting better".It is patently obvious that vast amounts of oil are being wasted, particularly in first world countries. The Hirsch Report itself admits (P. 24) that "67 percent of personal automobile travel, and 50 percent of airplane travel are discretionary". This means that 6.3 million barrels per day (roughly equal to the oil production of Iran+Iraq) are used in discretionary auto/air travel in the US alone. That's huge: 30% of US oil consumption, and 50% of US oil imports. And it's being wasted on non-mission-critical, optional travel. Or consider commuting. The average commute in the US is 16 miles Source. Which means that, in a pinch, half the population could easily commute to work by bicycle. Those with longer commutes can conserve, while still maintaining functionality as usual, by car pooling, or driving a hyper-efficient vehicle, like the Veken hybrid scooter, which is available today for less than $3000, and gets 180mpg (you can see a video here. More info here). On top of that, you can count numerous other demand-side measures, like telecommuting, telepresence, or even gasoline rationing with tradeable credits. You could very easily draft a plan to eliminate half of US oil consumption (10mbd, or 1 Saudi Arabia) simply by trimming waste and lifestyle.

To answer your question: The large new supply of secure crude is going to come from conservation, i.e. U.S. commuters riding two-to-a-car instead of one-to-a-car etc.

Of course my point here is true, and it carries a lot of force. In fact, I've never met a doomer who didn't immediately acknowledge the validity of this point. There is no genuine "need" for people to commute to computerized desk jobs 100 miles away in 6000 lb. single-occupant SUVs. You don't even have to think about it; it's patently ridiculous. We waste staggering volumes of oil on frivolous lifestyle bullshit.

So the optimist solution is to gradually (or quickly, if need be) eliminate all this waste, and switch over the remaining essential part to alternate power sources. For example, the classic case would be a commuter who switches from a single-occupant 12mpg SUV to a 180mpg hybrid scooter, and then to an ∞ mpg electric scooter driven by solar or nuclear. Radically reduce oil use to the minimum necessary, and then substitute. That's the optimist solution in a nutshell.

Of course, the doomers are fully committed to horror and mayhem, and have a pre-packaged rebuttal to this solution too. They say that conservation and efficiency are poison to our economy because the economy is based on waste, and eliminating waste will send the economy into a death spiral. It sounds plausible the first time you hear it, but if you think about it carefully, you'll see the fallacy.

Consider the classic example: Jane was driving an SUV that got 12mpg. Then she purchased a hybrid scooter for $3000, which gets 180mpg. Assuming $5/gallon gas (due to post-peak conditions), car travel costs $.42/mile and scooter travel costs $0.03/mile. So when she rides her scooter, she's saving about $0.39/mile. At the scooter's top speed of 40mph, she's saving $15.60/hour. She's making as much money driving her scooter as she would working a well-paying second job. She'll pay off the moped in a few months, and after that it's all gravy. Lots of extra money in her pocket is hardly a negative for the economy. That money will get spent somewhere, and the people providing those goods and services will benefit.

This is the key point: Whenever you conserve oil, you also save money, and that money gets spent or invested, stimulating the economy. Unlike money spent on oil, which generally flows out of the country, money saved by conserving oil is far more likely to be spent in a way which stimulates the domestic economy and employment.

A recent study of efficiency efforts in California bears this out:

• Energy efficiency measures have enabled California households to redirect their expenditure toward other goods and services, creating about 1.5 million FTE (Full Time Equivalent) jobs with a total payroll of over $45 billion, driven by well-documented household energy savings of $56 billion from 1972-2006.So there you have it. Conservation is the easiest and best solution to peak oil, and it's highly beneficial to the economy. Careful examination shows the pessimist argument to be based on a series of fallacies.

• As a result of energy efficiency, California reduced its energy import dependence and directed a greater percentage of its consumption to in-state, employment-intensive goods and services, whose supply chains also largely reside within the state, creating a “multiplier” effect of job generation.

• The same efficiency measures resulted in slower growth in energy supply chains, including oil, gas, and electric power. For every new job foregone in these sectors, however, more than 50 new jobs have been created across the state’s diverse economy.

• Sectoral examination of these results indicates that job creation is in less energy intensive services and other categories, further compounding California’s aggregate efficiency improvements and facilitating the economy’s transition to a low carbon future.

Crude Oil At Sea Frustrates Efforts At Price Stability

Every time the oil market attempts to ignite a rally, an upsurge from the sea of crude stored on waterborne tankers snuffs it out.An LNG glut seems to be brewing as well. Hate to be repetitive, but whatever happened to that imminent cliff in natural gas that Matt Simmons was hysterically squealing about 6 years ago? With rising domestic production from shale and other unconventional natural gas plays, and now a surge of LNG, we seem to be swimming in the stuff.

The accumulation of oil held in "floating storage" gained speed in December, as available space in traditional onshore storage hubs dwindled due to the onslaught of excess supplies in the market. This floating storage is now among the biggest impediments to oil prices recovering any of the ground lost over the last six months. Companies are quick to sell cargoes at the hint of a turnaround in the oil market, unleashing a flood of oil onto a near-saturated landscape.

More oil is being produced than recession-stricken economies need, and oil prices have fallen as the extra crude fills storage terminals worldwide. Crude futures prices are down more than 70% from all-time record highs hit in July 2008. Light, sweet crude oil for March delivery on Tuesday settled 46 cents, or 1.1%, lower at $40.32 a barrel on the New York Mercantile Exchange.

The oil sitting at sea adds an extra layer of uncertainty about the extent of the supply overhang, which traders say must be whittled down for oil prices to rebound.

Tankers carrying up to 2 million barrels each are not counted in government inventory statistics, but can deliver their cargoes anywhere in the world. Ship trackers estimate that up to 80 million barrels may be on the water, or more than twice the amount kept in Cushing, Okla., the largest commercial storage center in the U.S.

Natural gas glut could hit U.S.

As many as seven massive natural gas export terminals are expected to start up overseas this year, expanding worldwide capacity by 20 percent and flooding markets with new supplies of the key power plant and heating fuel. Dozens of new tankers capable of carrying natural gas in a liquefied form are slated to hit the seas.And thanks to OilFinder for some more detail:

Just as these new supplies come on line, worldwide demand is expected to drop as the global recession deepens.

Operators of these new facilities are unlikely to cut back production, however, so shipments of liquefied natural gas will most likely head to the deepest markets with the greatest amount of natural gas storage capacity — the United States.

‘Counterintuitive’

“It’s completely counterintuitive,” said Murray Douglas, a global LNG analyst with Wood Mackenzie in Houston, who is predicting U.S. LNG imports will grow 30 percent to 456 billion cubic feet this year and to more than 1.1 trillion cubic feet by 2013.

“We don’t believe Asia and Europe will be in a position to absorb this new production, and the U.S. is the only market that can take it, that has a large amount of storage.”

The wave of imports might even be strong enough to challenge growing domestic natural gas production from various shale formations, including the Barnett Shale near Fort Worth and Fayetteville Shale in Arkansas.

“This can put pressure on U.S. gas prices and could delay the full development of some of the new shale projects,” Douglas said.

Other analysts, including Houston-based Waterborne Energy and Raleigh, N.C.-based Pan Eurasia Enterprises, agree that an American gas import surge may be coming.

Even the Department of Energy updated its LNG import predictions for 2009 recently to include the possibility of such a surge.

Surge in US Crude Stocks Blunts OPEC Cuts

OPEC cut crude oil output by nearly 1.3 million barrels a day in January in an attempt to tame the growing supply glut that is anchoring prices near $40 a barrel.

But as the Organization of Petroleum Exporting Countries tightened the taps, crude oil inventories in the U.S. were growing by 700,000 to 900,000 barrels a day. That growth rate, the most seen in the month of January in 85 years, and the highest in any month since at least October 2002, is a serious setback to OPEC's efforts.

[...]

Biggest Surplus Since 1990

That helped U.S. crude oil inventories balloon by the highest level in years. Crude inventories climbed by at least four times the average January rate over the last five years, which is the biggest rise in the month since 1924, EIA data show.

At 346 million barrels, crude stocks are the most since July 2007, when they topped 351 million barrels.

Crude stocks are sufficient to cover more than 24 days of current refinery demand, compared with a five-year average of 20 days, and the highest level since 1995.

What's more, crude stocks are likely to continue to gain. The EIA expects refinery runs in February and March to average 400,000 barrels a day below current levels.

Jan Stuart, economist at UBS Securities, said he expected refineries to slash operations to be below 70% of capacity on occasion in coming months, compared with an 83.5% rate in the Jan. 30 week. That implies a cut in crude runs of about 2 million barrels a day from current rates.

U.S. crude oil stocks haven't peaked in January in 55 years, data from the EIA show, a further indication of likely gains in coming months. Incentives for refiners to bulk up stockpiles are still in place, even as inventory at Cushing, Okla., the delivery point for the Nymex crude contract, stands at record levels.

[...]

The Myth of the Oil Crisis (MotOC) is a very recently published book (2008) by Robin Mills on the subject of oil, natural gas, and more broadly, energy. As the title suggests, Mills tackles the notion that we are on the brink of an “oil crisis,” known online largely by the monicker “peak oil,” from which the world will never recover. If Campbell and Laherrére are the professionals that gave the peak oil movement its credentialed weight (by being professional geologists), then Mills is perhaps the antithesis for the “debunking” movement. While the book is flawed, it presents a broad optimistic view of energy reserve availability and potential for development and supply of those reserves in the foreseeable future. What makes the book most important, however, is that Mills demonstrates, using easily accessed sources, that the imminent peak arguments are highly flawed and irrational.

Robin Mills is, according to his biographical blurb, “an oil industry professional with a background in both geology and economics. Currently (as of 2008), he is Petroleum Economics Manager for the Emirates National Oil Company in Dubai. Previously, he worked for Shell.” Mills is a fairly impressive person, even not including his graduate degree from Cambridge University (in petroleum geology), Then again, so are many of those who currently write about oil depletion from the “peak oil” side. What makes Mills different? For one, he's relatively young (born in 1976). But more importantly, he is someone who is currently in the thick of the oil business in the Middle East itself. Unlike many “peakniks,” Mills actively participates in the energy production business as I write this review. He is not some “armchair analyst” like many of us, and has more of a “veteran view” than many others seem to demonstrate.

Mills sets the stage by placing the oil commentators into five camps (examples chosen by me): The Geologists (Campbell, Laherrére, Deffeyes), The Economists (Odell, Lynch, CERA), The Militarists (who are actually made up of the militarists, media, and mercantilists), the Environmentalists (Greenpeace et al.), and the Neo-Luddites (Heinberg). It is important, I believe, to note that “The Geologists” doesn't refer to petroleum geologists, per se, but because they worked at some point in their careers as professional geologists. Mills notes that they can also be referred to as “Malthusians,” which is a fairly fitting appellation. Some may object to the rather broad categories that Mills uses to group the various commentators, however. After all, some actors clearly align with more than one camp. Nonetheless, it serves as a useful way to group the widely divergent views of the oil commentary community.

Mills' book's greatest strength is its ability to deconstruct the most frightening of the peak prophecies and show how they are either incorrect, or at the very least, misguided. He is thorough in demonstrating, through both data, and clear, well-sourced arguments, how the extreme pessimists of the energy commentary community are generally incorrect in their arguments and assumptions. He even demonstrates how Hubbert, commonly hailed as a sort of “peak oil prophet” (words mine), was hardly as accurate as he is shown to be. In fact, Mills scrutinizes Hubbert in the fourth chapter, entitled “Half-Full or Half-Empty?” Hubbert, despite his supposed accuracy, was actually fairly inaccurate on a lot of important issues, as Mills demonstrates in the following bullet points:

- Hubbert actually proposed 1965 as his most likely peak date (US oil production); 1970 was a fallback if secondary recovery proved to be more successful than he expected (as it did)

- Although arguably correct on the date of the peak, he was wrong about its height: total annual US production in 1970 was 20 percent (emphasis mine) higher than he expected...

- He forecast that world oil production would peak between 1995 and 2000 at 33 million bbl/day. The true figure was 75 million bbl/day in 2000, and it has continued to rise subsequently.(MotOC pg. 42.)

Another strength of Mills' book is the credence he pays toward economic factors. He shows, throughout the book, that economic factors play a significant role in energy production. One of the often ignored (or derided) factors in energy is the capital needed to keep it running smoothly. The Geologists see geography as the ultimate factor in deciding energy availability, but they are far too willing to ignore the fact that even assuming you have a powerful physical limitation in place, you cannot drill oil if you lack rigs and manpower. Unfortunately, we live in a world today where the physical and human capital needed to run the oil industry has become significantly scarcer than in decades past-- this is largely a consequence of the previous decades of incredibly cheap oil. These same low prices drove OPEC to reduce production as well, which allowed oil commentators (Simmons, for example) to say that Saudi Arabia is in a state of decline. Unfortunately for Simmons, KSA was merely responding rationally to low prices by reducing production. The reader will see a lot of this kind of debunking throughout the book. For some, it will be interesting to see the shriller voices of energy commentary dismantled. For many readers of this blog, however, it will be a rehashing of what has been said here by JD and others. Nonetheless, it is important stuff, and Mills does a good job of taking out some of the more pernicious fallacies with sound economic thinking.

Other topics that Mills deals with are unconventional oil, backdating (one of the more irritating traits of The Geologists), natural gas, geopolitics, demand, and finally the environment. I am glad to say that he does a good job of dealing with unconventional oil (it's not as impossible to produce as some say), backdating (basically, contemporary reserve growth is moved back in the past in order to make it look like we ain't finding more!), natural gas (energy of the future, he argues), and demand (not necessarily going to grow exponentially forever.) I was less impressed with his environmental arguments, mostly because I think he arrives from a strange foundation (The Stern Report). Regardless of my misgivings with his use of what I see as an unnecessarily alarmist paper, I believe it is a positive step to see petroleum executives treating CO2 emissions as a serious issue.

However, like I said at the beginning, there are problems with MotOC. For one, it is somewhat too technical for most laypersons to read without some difficulty. Mills does a commendable job with explaining the terminology as best as he can, but I sometimes found myself flipping to the glossary to relearn terms that I had forgotten from previous chapters. I also found myself occasionally having to reread sentences to figure out what Mills meant because he occasionally inserted sentences of length and complexity that would make Proust weary. While this is fine for an academic market that is used to dealing with long, convoluted prose, the book seems to be marketed more broadly toward a “well-educated” market. While Mills' sometimes awkward prose is not an overly serious issue, it does detract from the experience.

Overall, however, I recommend this book to the “armchair energy analysts” and anyone else who is interested in the topic of energy markets. It may not be groundbreaking for those of us who read this particular blog on a regular basis, but it is a useful text in the sense that it puts a great deal of important data at your fingertips, as well as giving a great deal of insight into the market itself. It is a challenging read, but it is definitely worth the time spent. I doubt it will turn any “doomers” or “peakniks” into optimists, but it will definitely put a lot of things into context for both “debunkers” and those sitting on the fence about the future. It is also, in my opinion, a good text to recommend to friends who stumble on to the “peak oil” scene for the first time, if only to give them insight into how flawed most of the doomsday arguments really are.

Peakoiloptimist.blogspot.com

Hugo Chavez Changes His Mind

Mark Goldes, Where Are You?

EEStor's New Patent

Well, It's Something: Polywell Review Panel Gives Thumbs-Up

Polywell Gets Another Crack?

Administrivia: Fixing Archive Links

Purdue Panel Finds Misconduct By Taleyarkhan

Lockheed Mumbles Something About EEStor

R.A. Nebel On Plasma Calculations

Peakoilanarchy.blogspot.com

Worldwide Protests Slam G8 Support of Nuclear, Coal, Oil

May 6, DC Petrocollapse Conference: Culture Change and Sustainable Post-Petroleum Living

Peak Opportunity! Earth Liberation and the Oil Endgame

Anarchism and the Peak oil Argument

Mission Accomplished! Operation Iraqi Liberation (and Peak Oil)

The End Of Civilization

* Radicollapse *

An Open Letter on the Green Scare

Peak Oil Anarchy Hits the Road, Dawg!

The Oil Drum

Drumbeat: April 30, 2009

On Choosing - A Hyperlocavore Responds to Catastrophe

The Risks of "Cap and Trade"

Drumbeat: April 29, 2009

Book Review: Oil 101

Post-peak mechanized agriculture: the RAMSES project

Drumbeat: April 28, 2009

Iraqi Oil: Black Gold or Black Hole?

New feature: Comment flagging

EnergyBulletin.net

Warning: date() expects parameter 2 to be long, string given in /home/davescom/public_html/rss2html.php on line 606

Warning: date() expects parameter 2 to be long, string given in /home/davescom/public_html/rss2html.php on line 607

Warning: date() expects parameter 2 to be long, string given in /home/davescom/public_html/rss2html.php on line 608

Warning: date() expects parameter 2 to be long, string given in /home/davescom/public_html/rss2html.php on line 609

Warning: date() expects parameter 2 to be long, string given in /home/davescom/public_html/rss2html.php on line 724

Warning: date() expects parameter 2 to be long, string given in /home/davescom/public_html/rss2html.php on line 725

Warning: date() expects parameter 2 to be long, string given in /home/davescom/public_html/rss2html.php on line 726

Warning: date() expects parameter 2 to be long, string given in /home/davescom/public_html/rss2html.php on line 727

Google | Peak oil